The global Electric Vehicle (EV) charging market is experiencing a paradigm shift, presenting high-growth opportunities for investors and technology providers. Driven by ambitious government policies, escalating private investment, and consumer demand for cleaner mobility, the market is projected to surge from an estimated $28.46 billion in 2025 to over $76 billion by 2030, at a CAGR of approximately 15.1% (Source: MarketsandMarkets/Barchart, 2025 data).

For global businesses seeking high-potential markets, understanding regional policy frameworks, growth metrics, and technological evolution is paramount.

I. Established Giants: Policy & Growth in Europe and North America

The matured EV markets in Europe and North America serve as crucial anchors for global growth, characterized by significant governmental support and a rapid push toward interoperability and high-power charging.

Europe: The Drive for Density and Interoperability

Europe is focused on establishing comprehensive and accessible charging infrastructure, often tied to stringent emissions targets.

- Policy Focus (AFIR): The EU’s Alternative Fuels Infrastructure Regulation (AFIR) mandates minimum public charging capacities along the main European transport network (TEN-T). Specifically, it requires dc fast-charging stations of at least 150 kW to be available every 60 km along the TEN-T core network by 2025. This regulatory certainty creates a direct, demand-driven investment roadmap.

- Growth Data: The total number of dedicated ev charging points in Europe is forecasted to grow at a CAGR of 28%, expanding from 7.8 million in 2023 to 26.3 million by the end of 2028 (Source: ResearchAndMarkets, 2024).

- Client Value Insight: European operators seek reliable, scalable hardware and software that supports open standards and seamless payment systems, ensuring compliance with AFIR and maximizing uptime for premium customer experience.

North America: Federal Funding and Standardized Networks

The U.S. and Canada are leveraging massive federal funding to build a cohesive national charging backbone.

- Policy Focus (NEVI & IRA): The U.S. National Electric Vehicle Infrastructure (NEVI) Formula Program provides significant funding to states for deploying DC fast chargers (DCFC) along designated Alternative Fuel Corridors. Key requirements often include 150 kW minimum power and standardized connectors (increasingly focusing on the North American Charging Standard – NACS). The Inflation Reduction Act (IRA) offers substantial tax credits, de-risking capital investment for charging deployment.

- Growth Data: The total number of dedicated charging points in North America is forecast to grow at a high CAGR of 35%, increasing from 3.4 million in 2023 to 15.3 million in 2028 (Source: ResearchAndMarkets, 2024).

- Client Value Insight: The immediate opportunity lies in providing NEVI-compliant DCFC hardware and turnkey solutions that can be rapidly deployed to capture the federal funding window, alongside robust localized technical support.

II. Emerging Horizons: The Potential of Southeast Asia and the Middle East

For companies looking beyond saturated markets, high-potential emerging regions offer exceptional growth rates driven by unique factors.

Southeast Asia: Electrifying Two-Wheeler and Urban Fleets

The region, heavily reliant on two-wheelers, is transitioning to EV mobility, often supported by public-private partnerships.

- Market Dynamics: Countries like Thailand and Indonesia are rolling out aggressive EV incentives and manufacturing policies. While overall EV adoption is catching up, the region’s increasing urbanization and growing vehicle fleets are boosting demand (Source: TimesTech, 2025).

- Investment Focus: Partnerships in this region should focus on battery-swapping technologies for the massive two- and three-wheeler market, and cost-competitive, distributed AC charging for dense urban centers.

- Localization Imperative: Success hinges on understanding local power grid constraints and developing a low-cost of ownership model that aligns with the disposable income of local consumers.

Middle East: Sustainability Goals and Luxury Charging

Middle Eastern nations, particularly the UAE and Saudi Arabia, are integrating e-mobility into their national sustainability visions (e.g., Saudi Vision 2030) and smart city projects.

- Policy and Demand: Government mandates are driving EV adoption, often targeting premium and high-end models. The focus is on establishing a high-quality, reliable, and aesthetically integrated charging network (Source: CATL/Korea Herald, 2025 discusses partnerships in the Middle East).

- Investment Focus: High-power Ultra-Fast Charging (UFC) hubs suitable for long-distance travel and integrated charging solutions for luxury residential and commercial developments present the most lucrative niche.

- Cooperation Opportunity: Collaboration on large-scale infrastructure projects with national energy and real estate developers is key to securing large, long-term contracts.

III. Future Trends: Decarbonization and Grid Integration

The next phase of charging technology moves beyond simply delivering power, focusing on efficiency, integration, and grid services.

| Future Trend | Technical Deep Dive | Client Value Proposition |

| Ultra-Fast Charging (UFC) Network Expansion | DCFC is moving from 150 kW to 350 kW+, reducing charging time to 10-15 minutes. This requires advanced liquid-cooled cable technology and high-efficiency power electronics. | Maximizing Asset Utilization: Higher power translates to faster turnaround, increasing the number of charge sessions per day and improving Return on Investment (ROI) for Charge Point Operators (CPOs). |

| Vehicle-to-Grid (V2G) Integration | Bi-directional charging hardware and sophisticated Energy Management Systems (EMS) that enable an EV to send stored energy back to the grid during peak demand. (Source: Precedence Research, 2025) | New Revenue Streams: Owners (fleet/residential) can earn revenue by selling power back to the grid. CPOs can participate in grid ancillary services, transforming chargers from energy consumers into grid assets. |

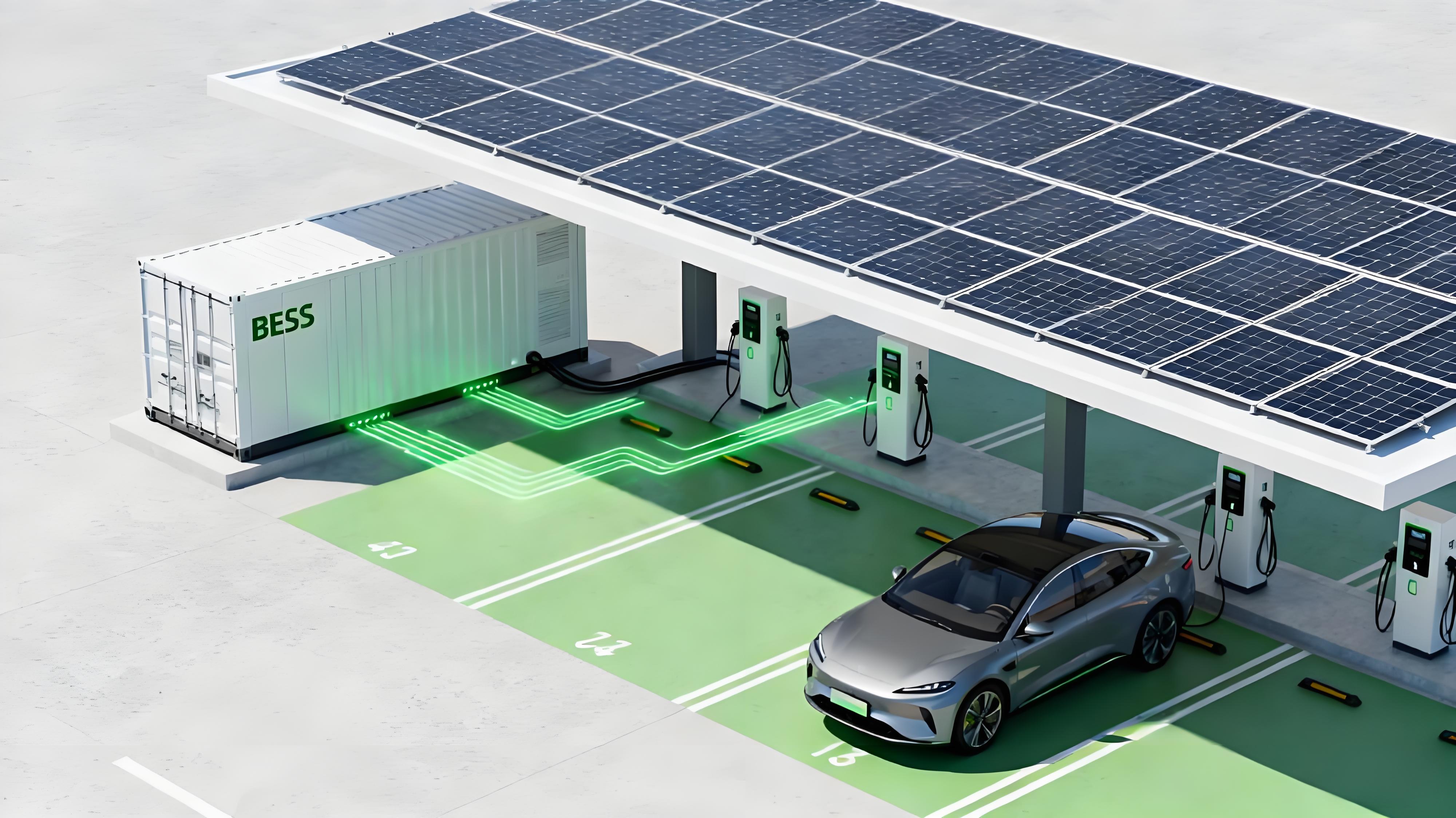

| Solar-Storage-Charging | Integrating EV chargers with on-site Solar PV and Battery Energy Storage Systems (BESS). This system buffers the grid impact of DCFC, utilizing clean, self-generated power. (Source: Foxconn’s Fox EnerStor launch, 2025) | Energy Resilience and Cost Savings: Reduces reliance on expensive peak-hour grid electricity. Provides backup power and helps bypass costly utility demand charges, leading to a much lower operational expenditure (OPEX). |

IV. Localized Partnership and Investment Strategy

For foreign market penetration, a standardized product strategy is insufficient. Our approach is to focus on localized delivery:

- Market-Specific Certification: We provide charging solutions pre-certified for regional standards (e.g., OCPP, CE/UL, NEVI compliance), reducing time-to-market and regulatory risk.

- Tailored Technical Solutions: By using a modular design philosophy, we can easily adapt power output, connector types, and payment interfaces (e.g., credit card terminals for Europe/NA, QR-code payment for SEA) to meet local user habits and grid capabilities.

- Client-Centric Value: Our focus is not just on the hardware, but on the software and services that unlock profitability—from smart load management to V2G readiness. For investors, this means a lower-risk profile and higher long-term asset value.

The global EV charging market is entering a rapid deployment phase, moving from early adoption to mass infrastructure build-out. While established markets offer the security of policy-driven investment, emerging markets in Southeast Asia and the Middle East provide the excitement of exponential growth and unique technological niches. By focusing on data-backed insights, technological leadership in UFC and V2G, and genuine localization, Our CHINA BEIHAI POWER CO.,LTD. are uniquely positioned to partner with global clients seeking to capture the next wave of opportunity in this $76 billion market.

Post time: Oct-28-2025